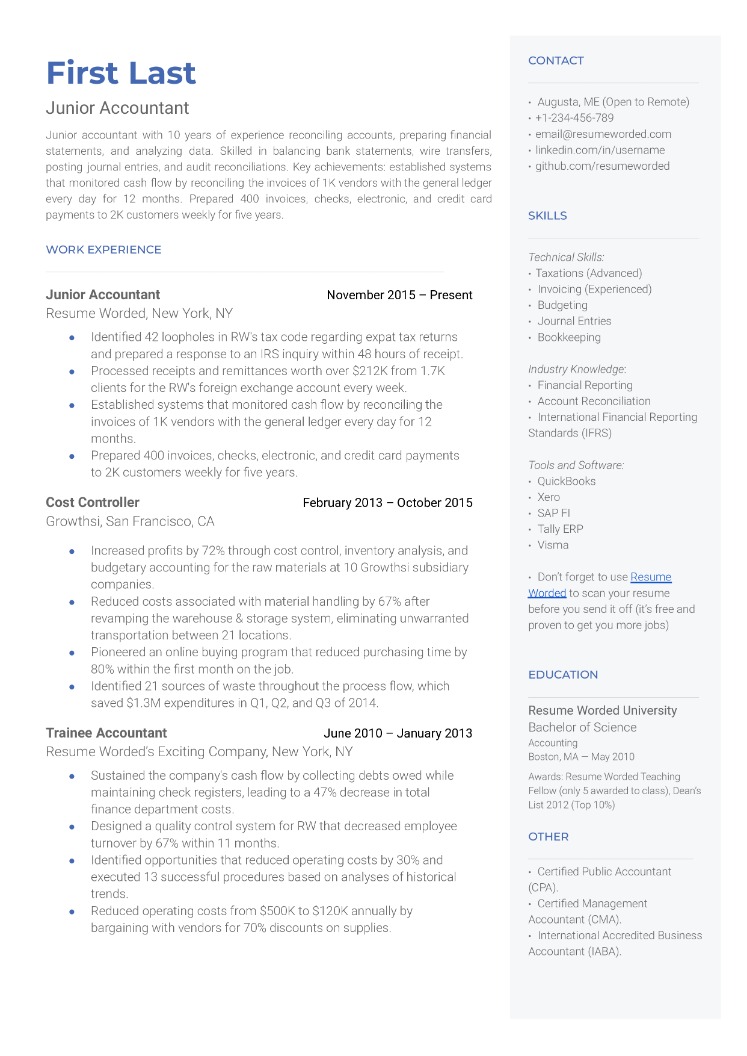

Running a small business can be challenging, especially when it comes to managing finances. Accounting is an essential function for any business, regardless of its size. Hiring an experienced accountant for small business can help you navigate financial complexities, maximize profits, and ensure compliance with tax laws.

Read more about accountant for small business here.

Benefits of Hiring an Accountant for Small Business

- Expertise: Accountants have specialized knowledge and skills to handle financial matters efficiently.

- Time-saving: Outsourcing accounting tasks allows you to focus on other aspects of your business.

- Cost-effective: Preventing financial errors and inefficiencies can save you money in the long run.

- Tax compliance: Accountants can help you stay compliant with tax regulations and maximize deductions.

FAQs about Accountants for Small Business

What services can an accountant provide for my small business?

An accountant for small business can offer a range of services, including bookkeeping, financial analysis, tax preparation, payroll, and strategic financial planning.

How much does it cost to hire an accountant for my small business?

The cost of hiring an accountant for a small business can vary based on the scope of services needed and the accountant’s experience. It is essential to discuss fees upfront to ensure transparency.

When should I hire an accountant for my small business?

It is advisable to hire an accountant as soon as you start your business. They can help set up financial systems, track expenses, and plan for future growth effectively.

Overall, investing in an accountant for small business can provide invaluable support in managing your finances and achieving long-term success. Don’t overlook the importance of professional financial guidance for your small business!