Are you looking to grow your money with minimal risk involved? The key lies in finding the best savings rates. With the right savings account, you can maximize your savings and watch your money grow over time. Here’s everything you need to know about finding the best savings rates in the market:

What are Savings Rates?

Savings rates refer to the annual interest rate that a financial institution pays you for keeping your money in a savings account. This rate is expressed as a percentage and determines how much you earn on your savings over time.

How to Find the Best Savings Rates

When looking for the best savings rates, there are a few key factors to consider:

- Interest Rate: Look for savings accounts with high-interest rates to maximize your earnings.

- Compounding Frequency: Consider how often the interest is compounded as it can affect your overall earnings.

- Minimum Balance Requirements: Some accounts may require a minimum balance to earn the advertised rate.

- Fees: Watch out for any fees that may eat into your savings.

Benefits of High Savings Rates

Choosing a savings account with the best savings rates can offer the following benefits:

- Earning higher interest on your savings

- Building your savings faster

- Increasing your financial security

FAQs About Savings Rates

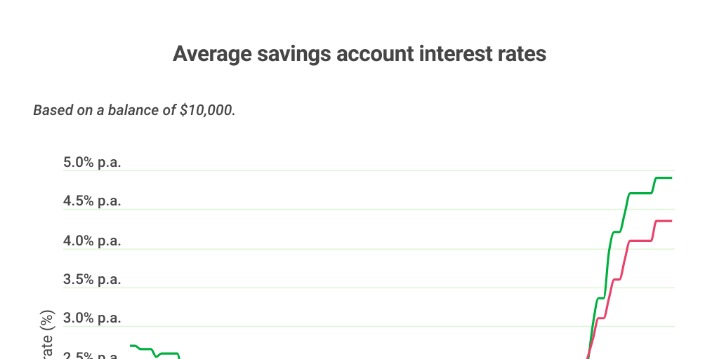

What is the average savings rate currently?

The average savings rate in the market typically ranges from 0.01% to 2.00%, but it can vary based on the type of account and current market conditions.

Read more about high yield savings account here.

Are online banks a good option for high savings rates?

Online banks often offer higher savings rates compared to traditional brick-and-mortar banks due to lower overhead costs. They can be a good option for finding the best savings rates.

By seeking out the best savings rates and making informed choices, you can secure a brighter financial future for yourself. Start comparing savings accounts today and watch your savings grow!