In today’s fast-paced world, effective finance management is more crucial than ever. Whether you’re accumulating wealth or simply trying to maintain your current financial standing, understanding the essential aspects of finance can make a considerable difference.

The Basics of Personal Finance

Personal finance refers to the management of an individual’s or family’s financial activities. These activities typically include:

- Budgeting

- Savings

- Investments

- Debt Management

- Retirement Planning

Read more about Rhys Aldous here.

Budgeting: The Foundation of Financial Health

Effective budgeting involves planning how to allocate your income to different expenses. This helps you ensure that you are living within your means. Key steps to creating a budget include:

- Tracking your income and expenses

- Setting financial goals

- Creating a realistic spending plan

- Regularly reviewing and adjusting as needed

Savings: A Pillar of Financial Security

Building a savings fund is essential for unforeseen expenses and long-term goals. Various types of savings accounts can offer different benefits:

- Emergency Fund

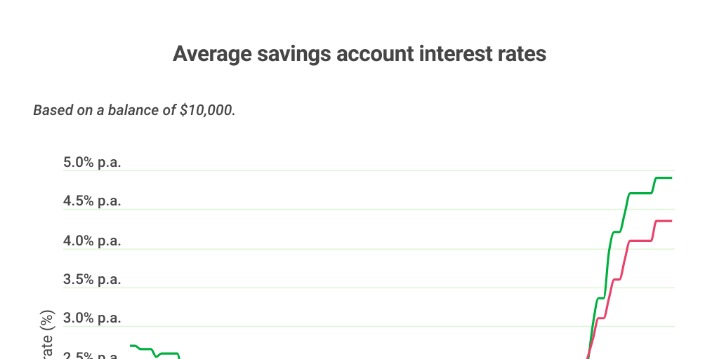

- High-Yield Savings Account

- Certificates of Deposit (CDs)

- Money Market Accounts

Investment Strategies for Financial Growth

Investing is a powerful tool for wealth accumulation. Here are common forms of investments:

- Stock Market

- Bonds

- Mutual Funds

- Real Estate

Understanding Risk and Return

Every investment carries its own risk and return profile. It’s important to diversify your investments to balance potential returns with acceptable risk levels.

Debt Management: Avoiding Financial Pitfalls

Debt can be a major obstacle to financial freedom. Effective strategies include:

- Paying off high-interest debt first

- Consolidating debts

- Negotiating lower interest rates

- Creating a debt repayment plan

Retirement Planning for a Secure Future

Planning for retirement is a critical component of finance. Options for retirement accounts include:

- 401(k) plans

- Individual Retirement Accounts (IRAs)

- Roth IRAs

- Pensions

FAQs on Personal Finance

What is the most important aspect of managing personal finance?

Creating and sticking to a budget is essential. It helps you understand where your money is going and ensures you are saving and investing appropriately.

How can I start investing with minimal experience?

Begin with low-risk options like savings accounts or mutual funds. Educate yourself through financial news, courses, and books. Consider consulting with a financial advisor for guided advice.

Why is debt management crucial?

High levels of debt can lead to financial stress and limit your ability to save or invest for the future. Effective debt management helps maintain a healthy financial balance.

Managing your finance effectively is not just about money; it’s about ensuring long-term stability and achieving your personal financial goals.