How to Spot a Fake PDF: Technical and Visual Checks

Identifying a forged document begins with a careful blend of visual inspection and technical analysis. Start by examining the obvious signs: inconsistent fonts, mismatched alignment, and irregular spacing around numbers or headers. A scanned invoice or receipt often shows uniform grain or texture; when parts appear unnaturally sharp or the background is uneven, image manipulation may be present. Look for duplicated logos, color shifts, or elements that don’t align with the issuer’s usual design standards. These visual cues are frequently the first indication of detect fake pdf or tampered content.

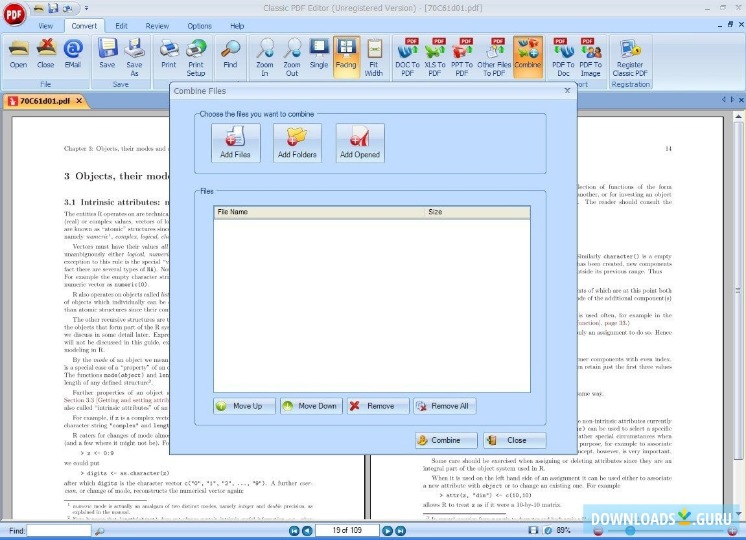

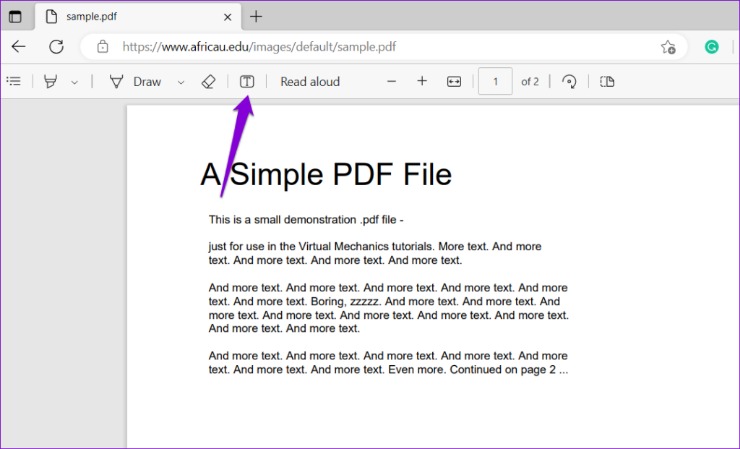

On the technical side, check the file properties and metadata. PDF files store information such as author, creation and modification dates, software used to generate the file, and XMP metadata. Sudden changes in timestamps or metadata that reference consumer-grade editing tools rather than business software can signal alteration. Validate the document’s digital signatures and certificates; a valid signature ties a document to a known identity and any break in that chain indicates potential fraud. If the signature verification fails or the certificate has been revoked, treat the document as suspect.

Another effective technique is to extract text using OCR and compare it to the visible content. OCR may reveal hidden layers or text anomalies that suggest copy-paste edits. Examine embedded fonts and images: missing or substituted fonts and low-resolution images layered into a high-resolution document are red flags. For organizations handling high volumes of PDFs, automated scanners that flag metadata inconsistencies, suspicious font substitutions, or embedded scripts are essential. Combining these manual and automated checks increases the likelihood of catching attempts to detect pdf fraud.

Detecting Fraud in Financial Documents: Invoices and Receipts

Financial documents like invoices and receipts are prime targets for fraud because they directly affect cash flow and accounting. Start by verifying transaction-level details: match invoice numbers, vendor names, and purchase order references against your internal records. Cross-check bank account details with previously validated vendor information; fraudsters often alter account numbers to redirect payments. A line-by-line reconciliation against purchase orders and delivery confirmations can expose phantom charges or invoices for goods and services never received.

Scrutinize the numerical formatting and tax calculations. Invoices that contain rounding errors, incorrect tax rates, or totals that don’t reconcile to subtotals may have been manually altered. Check for unusual billing cycles, sudden changes in pricing, or new contact information. Confirm supplier contact details independently using trusted directories rather than relying on the contact information present in the PDF, which can be modified to hide a fraudulent beneficiary. Employing a dual-approval workflow for high-value payments reduces the chance that a single person will authorize an illegitimate invoice.

For receipts, compare timestamps, payment method details, and POS identifiers to the store’s typical patterns. Receipts that show implausible purchase times, improbable item combinations, or unusual discounts should be investigated. When possible, contact the vendor to confirm the transaction and request original paperwork. Utilize digital verification methods such as checking for digital signatures, QR code validation, or secure receipt verification systems adopted by reputable merchants. These steps help to reliably detect fraud invoice and detect fake invoice attempts before they result in financial loss.

Case Studies and Practical Tools to Verify Document Authenticity

Real-world examples illustrate common attack patterns and effective defenses. In one case, a mid-sized company almost paid a six-figure invoice that contained a single digit change in the bank account number. Manual reconciliation caught the discrepancy when the vendor’s registered account did not match the invoice. Another organization discovered widespread fake receipts after an internal audit flagged multiple refunds processed for non-existent returns; forensic inspection showed copied logos and pasted transaction IDs. These scenarios underscore how routine controls and attention to detail stop fraud before it escalates.

Practical tools complement manual checks. Metadata viewers reveal authoring tools and modification histories. PDF forensic tools analyze embedded objects, scripts, and layers; they can identify anomalies like added white rectangles that hide text or replaced images. Hash and checksum verification helps confirm whether a file has been altered since it was signed. Online verification platforms can automate many of these checks, parsing content for inconsistencies and comparing fields against known templates. When used correctly, such tools make it simple to detect fraud in pdf by surfacing hidden modifications and suspicious signatures.

Training and process changes matter as much as technology. Implementing two-person approvals for supplier changes, regular vendor master audits, and mandatory independent supplier confirmations for new payment instructions reduces exposure. Maintain an incident log of attempted frauds to identify patterns—common red flags include new email domains that closely mimic legitimate ones, last-minute urgency notes, and invoices submitted outside of standard invoicing cycles. Combining policy, education, and automated verification delivers a resilient defense against attempts to detect fake receipt or detect fraud receipt, and helps protect organizational finances and reputation.