Singapore’s property market has garnered significant attention in recent years, particularly with the introduction of Additional Buyer’s Stamp Duty (ABSD). Homebuyers are often curious about how to avoid ABSD and explore avenues for buying a second property in Singapore without ABSD. This article delves into crucial methods for avoiding ABSD Singapore and makes the process more manageable for potential investors.

Understanding ABSD

The Singaporean government introduced Additional Buyer’s Stamp Duty to ensure a stable and sustainable property market. ABSD is a form of tax payable on residential property purchases, with different rates applicable based on the buyer’s profile.

Eligible Profiles and ABSD Rates

Singapore Citizens, Singapore Permanent Residents, and Foreigners pay varying rates of ABSD depending on the number of properties owned. To stay compliant and strategize effectively, understanding your eligibility and corresponding rates is essential.

How to Avoid ABSD

When investigating how to avoid ABSD, several legitimate strategies exist. Here are a few you can consider:

Purchase Under Different Names

If you are married, consider buying the first property under one spouse’s name and the second property under the other’s name. This method can help you avoid being subjected to the higher ABSD rates imposed on second and subsequent properties.

Decoupling

Decoupling involves transferring ownership from one spouse to another, effectively changing the property count under each owner’s name. This is particularly beneficial for married couples seeking to buy a second property without incurring ABSD.

Property Transfer to a Trust

Setting up a trust can be a viable option for purchasing a second property while avoiding ABSD Singapore. Parents often use this strategy for buying property under their children’s names. It’s crucial, however, to consult legal and financial advisors to navigate this sophisticated route effectively.

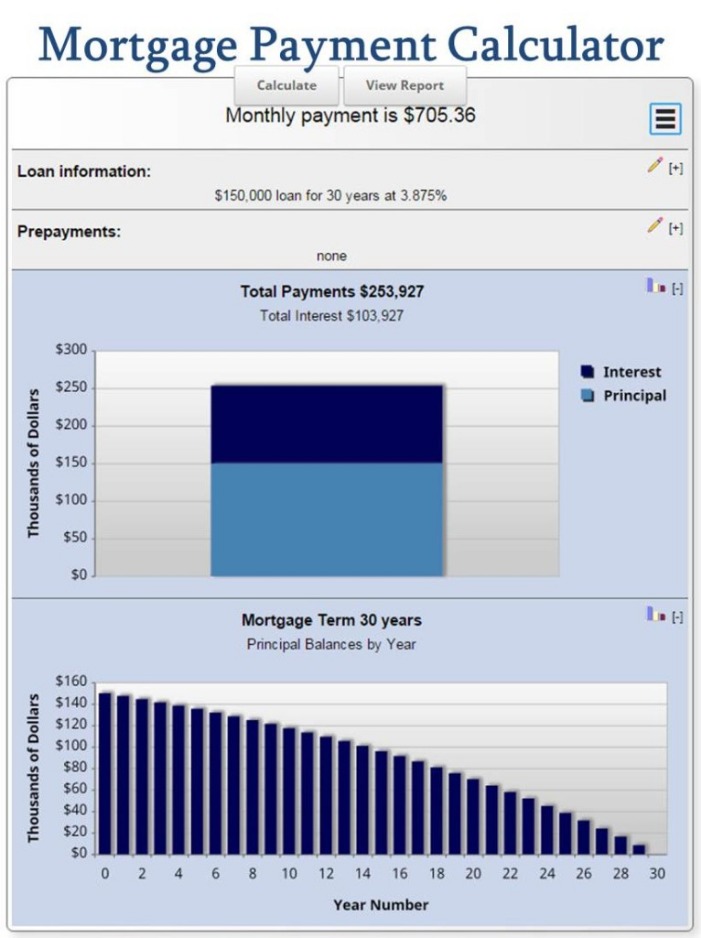

Financing Options for Your Second Property

When planning to buy a second property in Singapore without ABSD, explore diverse financing options:

Refinancing

Read more about How to buy second property in singapore without absd here.

Refinancing offers a way to access funds at potentially lower interest rates, aiding your investment strategy without incurring ABSD. Ensure to compare different financial institutions to select the best refinancing package.

Leveraging Equity

If you own an existing property, leveraging its equity might provide the necessary capital for a second purchase. This approach, coupled with other strategies, can help mitigate ABSD costs.

Consult Professionals

Professionals such as property consultants, legal advisors, and financial planners are invaluable in your journey to buying a second property in Singapore without ABSD. Their guidance ensures compliance with prevailing regulations while optimizing your investment strategy.

In conclusion, with thoughtful planning and strategic approaches, avoiding ABSD Singapore is achievable. Whether through purchase strategies, financial restructuring, or professional consultation, the right advice and tactics can make a significant difference.