For many individuals who have spent decades building their businesses from the ground up, considering an Exit Strategy for Retiring Business Owners can feel like unfamiliar territory. The process, however, is crucial for ensuring a smooth transition and maintaining the company’s legacy. Understanding and implementing effective Business Succession Planning strategies can make all the difference.

Crafting a Comprehensive Exit Strategy

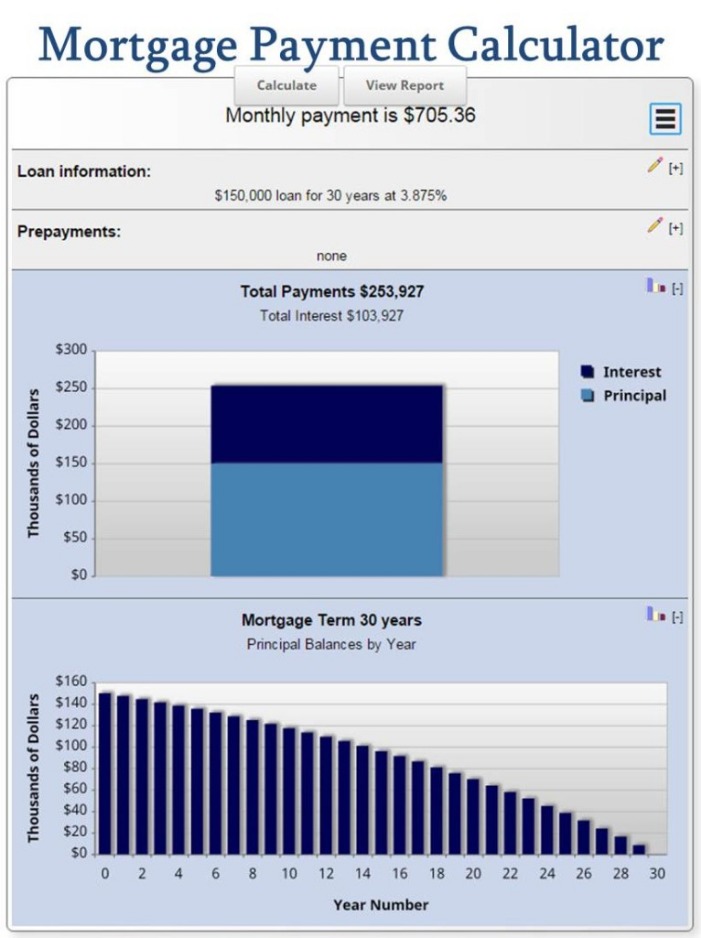

A well-executed Exit Strategy for Retiring Business Owners addresses various key components, ranging from financial planning to ensuring a smooth operational transition. Start by consulting trusted advisors who can help assess business value, tax obligations, and retirement needs. This strategy can also significantly impact other factors like employee retention and client satisfaction.

Choosing the Right Time: Selling the Business Before Retirement

Timing is everything. Selling Business Before Retirement is an attractive option for many, allowing owners the opportunity to maximize value when market conditions are favorable. It’s essential to start the process well in advance to prepare the business, attract the right buyers, and negotiate terms that align with your financial goals.

Exploring Inheritance and Sale Options

Another aspect to consider within the context of Business Succession Planning is the potential of an Inheritance Business Sale. This can involve passing the business to a family member or another trusted successor. Such a transfer requires careful legal and financial planning to ensure the business continues to thrive under new leadership.

Common Methods for an Inheritance Business Sale

The two most common methods for facilitating an Inheritance Business Sale are through gifting or selling the business outright to a family member or a trusted employee. Gifting may offer some tax benefits but can complicate estate planning. Conversely, selling the business might ensure immediate financial gain but could introduce tension if poorly managed.

Critical Steps for a Retiring Business Owner Sale

The culmination of meticulous planning and execution is the final Retiring Business Owner Sale. Ensuring that all legal, financial, and operational aspects are secured is vital to achieving a seamless transition. Proper documentation and clear communication can help mitigate any potential issues that may arise during or after the sale.

Optimizing Value Before the Sale

To ensure a successful Retiring Business Owner Sale, consider optimizing aspects of the business that would appeal to potential buyers. This might include modernizing operations, obtaining customer testimonials, enhancing branding, and streamlining accounting practices. Addressing these areas can significantly increase the business’s market value.

Read more about Business Succession Planning here.

Ultimately, careful planning and execution of each step in your exit strategy can allow you to retire with peace of mind, knowing that the business you’ve committed so much to can continue to flourish without you. By focusing on Exit Strategy for Retiring Business Owners, Business Succession Planning, and Selling Business Before Retirement, you can ensure that your legacy lives on and provides financial security for your future.